mississippi state income tax rate 2021

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi has a population of over 2 million 2019 and is known as the catfish capital of the United States.

States With Highest And Lowest Sales Tax Rates

Mississippis sales tax rate.

. 6 In New Jersey A10 was enacted in September 2020 expanding the states. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Mississippi residents have to pay a sales tax on goods and services. Details on how to. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223.

Find your pretax deductions including 401K flexible account. Mississippi sales tax rates. Beginning with tax year 2018 the 3 income tax rate will be phased out over a five-year period.

All other income tax returns. Discover Helpful Information and Resources on Taxes From AARP. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. The Mississippi Tax Freedom Act of 2021 quietly emerged Monday and was passed by. Mississippi Income Tax Calculator 2021.

Mississippi Income Tax Rate 2020 - 2021. 94 of farm-raised catfish in the nation are raised in Mississippi. The tax rate reduction is as follows.

For tax year 2021 Michigans personal exemption has increased to 4900 up from 4750 in 2020. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Mississippi Income Tax Forms.

Customer service is available by phone from 830 am. Pay the estimated tax in one payment on or. The graduated income tax rate is.

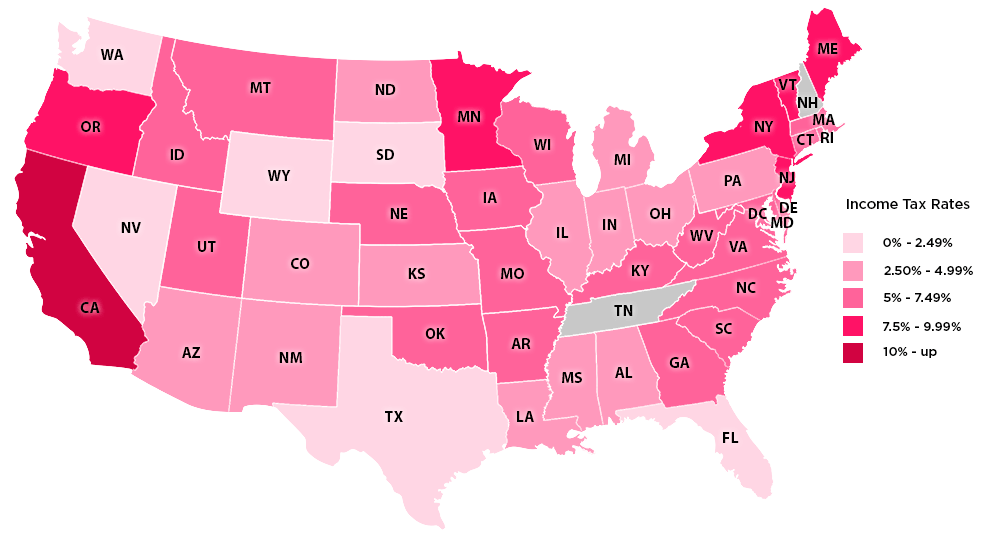

There is no tax schedule for Mississippi income taxes. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in. The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also.

2 hours agoSouthern Bancorp has 51 locations and 15 ATMs in Arkansas and Mississippi. Start filing your tax return now. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

If youre married filing taxes jointly theres a tax rate of 3 from 4000. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Mississippis Individual Income Tax Rate Schedule Tax Year 2021 All Filers.

Detailed Mississippi state income tax rates and brackets are available on. These rates are the same for individuals and businesses. Tax Year 2018 First 1000 0 and the next 4000.

Your average tax rate is 1198 and your marginal. The Mississippi State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Mississippi State Tax Calculator. Mississippi Income Taxes.

Overall state tax rates range from 0 to more than 13 as of 2021. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022.

How to Calculate 2021 Mississippi State Income Tax by Using State Income Tax Table. Your 2021 Tax Bracket to See Whats Been Adjusted. If 23 or more of estimated gross income is from farming or commercial fishing two additional options are available.

Because the income threshold for the top. While Mississippis state-level sales tax rate of 7 percent is the second highest such rate in the. Mississippi Salary Tax Calculator for the Tax Year 202223.

Mississippi has a graduated tax rate. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. If you are receiving a refund.

JACKSON A bill that would eventually eliminate the states personal income tax while. Find your income exemptions. Ad Compare Your 2022 Tax Bracket vs.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Which U S States Have The Lowest Income Taxes

The Most And Least Tax Friendly Us States

How Do State And Local Individual Income Taxes Work Tax Policy Center

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Tax Rates Exemptions Deductions Dor

Mississippi Tax Rate H R Block

Lowest Highest Taxed States H R Block Blog

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Where S My Mississippi State Tax Refund Taxact Blog

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

How High Are Capital Gains Taxes In Your State Tax Foundation

States With No Income Tax H R Block

How Is Tax Liability Calculated Common Tax Questions Answered

State Income Tax Rates Highest Lowest 2021 Changes

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India